Operation Keselamatan Jaya 2026 Launched, 9 Violations Targeted

02 February 2026, 08:00 WIB

The PKB and BBNKB levy policy will take effect on February 1, 2025. Here are the calculations for the South Tangerang region.

KatadataOTO – Starting February 1, 2025, motor vehicle owners in several regions outside of Jakarta will face an additional tax, namely the PKB (Motor Vehicle Tax) surcharge.

For your information, this rule is legally regulated in Law Number 1 of 2022 concerning Financial Relations Between the Central Government and Regional Governments.

The amount of tax will certainly vary depending on the type of vehicle and the details of the PKB surcharge implemented in the respective region.

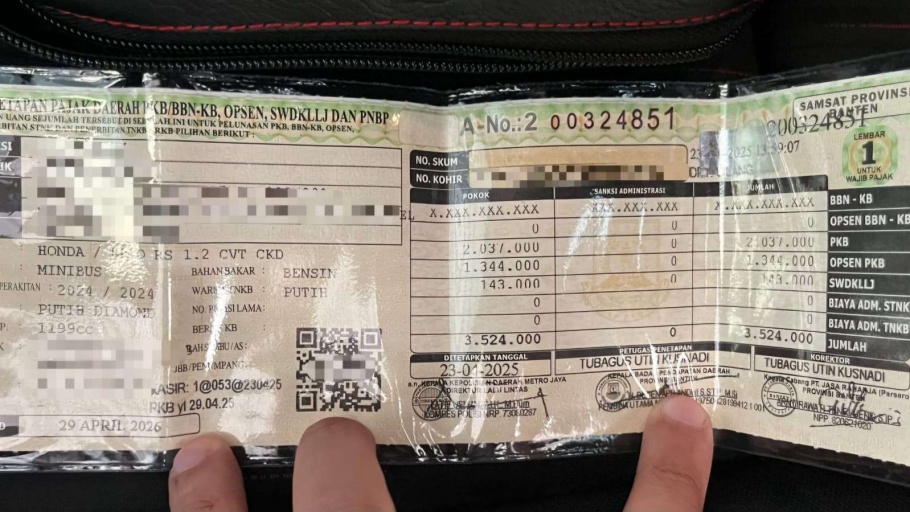

One piece of data received by KatadataOTO details that the car's PKB in the South Tangerang area for a Honda Brio RS is known to be around Rp 2.03 million, plus the SWDKLLJ (Mandatory Road Traffic Accident Fund Contribution) of Rp 143,000.

Then there is an additional PKB surcharge column that did not exist before. It states that the fee to be paid by the owner is around Rp 1.34 million. The total tax for the Honda Brio RS is around Rp 3.52 million.

For comparison, on last year's valid Vehicle Registration Certificate, the Honda Brio RS was charged a PKB of around Rp 2.77 million. With the addition of the SWDKLLJ of Rp 143,000, the total tax to be paid by the owner was around Rp 2.91 million.

So, roughly calculated, there is an increase of around Rp 610,000 for the Honda Brio RS tax. This calculation may differ depending on the policies and the amount of the surcharge in each vehicle owner's region.

Previously, it was claimed that the PKB surcharge would not burden taxpayers. This is because the base PKB figure is adjusted after the surcharge is added.

Nevertheless, referring to the calculation above, it is certain that the amount has increased compared to last year.

First, know the basic tax rate. For example, for a vehicle with an NJKB (Motor Vehicle Sale Value) of around Rp 200 million for a first vehicle.

Following the relevant provincial regional regulation, the rate is 1.1 percent. Thus, the PKB owed is 1.1 percent x Rp 200 million, which is Rp 2.2 million.

Then, the PKB surcharge is 66 percent multiplied by Rp 2.2 million, resulting in around Rp 1.45 million. Therefore, the total to be paid by the taxpayer is Rp 2.2 million + Rp 1.45 million = Rp 3.65 million.

The new rule in Law Number 1 of 2022 also regulates the adjustment of the tax rate for the first vehicle. Thus, it is claimed that the surcharge will not burden vehicle owners.

Related Articles

02 February 2026, 08:00 WIB

19 January 2026, 09:00 WIB

10 January 2026, 09:00 WIB

08 January 2026, 08:00 WIB

07 January 2026, 11:00 WIB

Latest

02 February 2026, 10:00 WIB

Sales are trailing competitors, and MG declined to elaborate on its sales target for 2026.

02 February 2026, 09:00 WIB

Chery hybrid cars offer more benefits to consumers in Indonesia, making them a popular choice.

02 February 2026, 08:00 WIB

The Police launched Operation Keselamatan Jaya 2026 to curb the number of accidents and traffic violations on the roads.

02 February 2026, 07:00 WIB

Yamaha is confident that the target set by AISI can be achieved this year, with several conditions.

01 February 2026, 17:17 WIB

Toyota FT 86, Vespa Corsa 125, and Toyota Alphard are three of Reza Arap's many vehicles.

01 February 2026, 15:00 WIB

Shell, BP AKR, and Vivo lowered fuel prices for the February 2026 period by varying amounts.

01 February 2026, 13:00 WIB

Toyota Motor Corporation is paying closer attention to its sales in Indonesia, which have significantly declined.

01 February 2026, 11:00 WIB

Toyota group sales break a new record and become the world's best-selling manufacturer in 2025, surpassing Volkswagen.